1. Keep track of what you spend on improving your money

If you don’t know what and where you spend each month, you might be able to change your spending habits.

The first step to better money management is to be aware of how much you spend. Use an app like MoneyTrack to keep track of how much you spend on non-essentials like going out to eat, going to the movies, and even your daily cup of coffee. Once you are more aware of your bad habits, you can make a plan to change them.

2. Reduce!

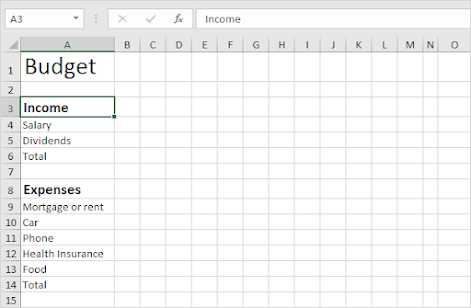

Creating a budget, keeping track of your daily costs, holding yourself accountable, and measuring your progress toward your financial goals can be a pain in the rear.

So, look for ways to make your money life easier whenever you can.

This has nothing to do with how specific your budget is. The more detailed your budget is, the easier it is to make decisions during the month that are good for your budget.

3. Tell the difference between needs and wants

4. Every month, pay all of your bills on time

5. Save money so you can buy big things

When you need to buy something big right away, like a house or car, certain types of loans and debt can help. But cash is the safest and cheapest way to pay for other important transactions.

When you pay cash, you don’t have to worry about interest or getting into debt that will take you years or even decades to pay off. You can put the money you saved into a bank account where it will earn interest while you wait to make your purchase.0